Introduction

If you trade in stock market on any business day, your stock broker sends you a contract note at the end of the day which gives details all the trades done by you during the day. This contract note is a bill which lists buying and selling cost and other costs incurred by you in the process. So let's learn about these charges in detail. Why and how much is it charged?

Types of Expenses

- Securities/Commodities

- transaction tax Transaction/Turnover Charges

- Stamp charges

- SEBI charges

- Brokerage charges

- Goods and Service Tax

- Securities/Commodities Transaction Tax

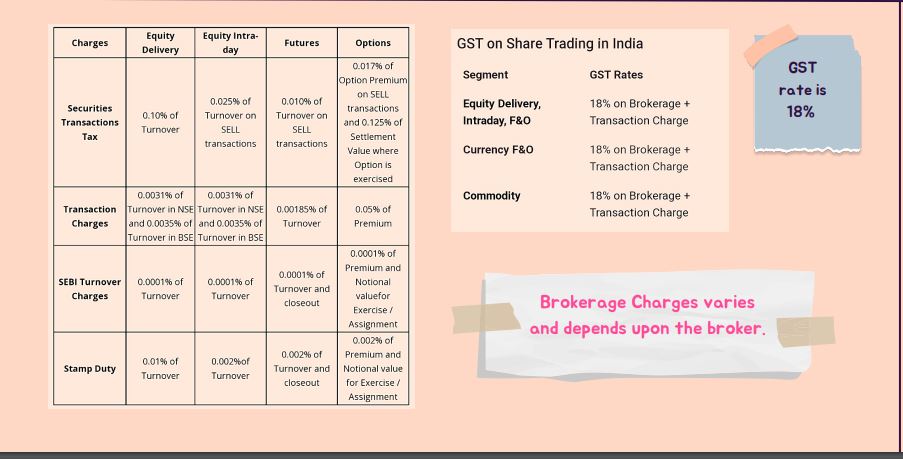

Tax by the government when transacting on the exchanges. Charged as above on both buy and sell sides when trading equity delivery. Charged only on selling side when trading intraday or on F&O. STT is levied on every trade of Equity Shares, Derivatives , Mutual Funds. whereas, CTT which is levied on only to sellers on non-agri commodities.

2.Transaction/ Turnover Charges

Transaction Fee is changed by Share Brokers in India for trades executed at stock exchanges (BSE, NSE, MCX). Also known as turnover fee, transaction fee is a combination of Exchange Turnover Charges and Clearing Charges. Transaction fee is charged for trading segments including equity (intraday, delivery, F&O), Currency Derivatives and Commodities.

3.Stamp Charges

Stamp duty is a state levy paid to register a document, typically an agreement or transaction paper between two or more parties, with the registrar. Stamp duty is charged uniformly irrespective of the state of residence effective from July 1st, 2020. Stamp charges by the Government of India are as per the Indian Stamp Act of 1899 for transacting in instruments on the stock exchanges and depositories.

4. SEBI Charges

SEBI stands for the Securities exchange board of India and it is the security market regulator. SEBI makes the rules and regulations on the exchanges for its proper functioning. SEBI Turnover fee is charged on both sides of the transaction and is the same for all equity intraday, delivery, futures, and options trading. The SEBI turnover charge is equal to Rs 10 per crore of the total turnover.

5.Brokerage Charges

The fee that brokers charge for providing their services is known as brokerage charges. Broker is a financial intermediary through which you can trade in stock markets. The brokerage is calculated on the percentage of the total cost of shares either purchased or sold. These are not uniform and often vary from every broker. It also depends on the type of transactions you make.

6.Goods and Service Tax (GST)

GST is an indirect form of tax levied by the government on business entities for providing goods and services to their customers. The rate is decided by the government and may vary from time to time. Ultimately you as an end customer have to bear the cost of GST charged by the government on all the entities providing their services when you do a transaction in stock market. Hence, you will find that your stock broker charges GST on all the charges mentioned in the contract note other than government levies.

*Brokerage Charges varies and depends upon the broker.