A lot of young investors who have seen their portfolios in the red for the first time, due to market actions in the last few days, have started to panic. The net returns have turned negative as the portfolios comprise of only equity and related products. This situation has again brought to the spotlight the importance of investing in fixed income securities that are independent of the stock market situations.

Why Fixed Income Securities

A person needs Rs 15 lakhs after 15 years to meet the education needs of his/her child. The person invests in stock markets is not sure whether he will be able to get the required amount at the relevant time. Hence, the person invests in fixed income securities as they give him the following advantages:

- Guaranteed returns

- Guaranteed time frame

- Tax Savings*

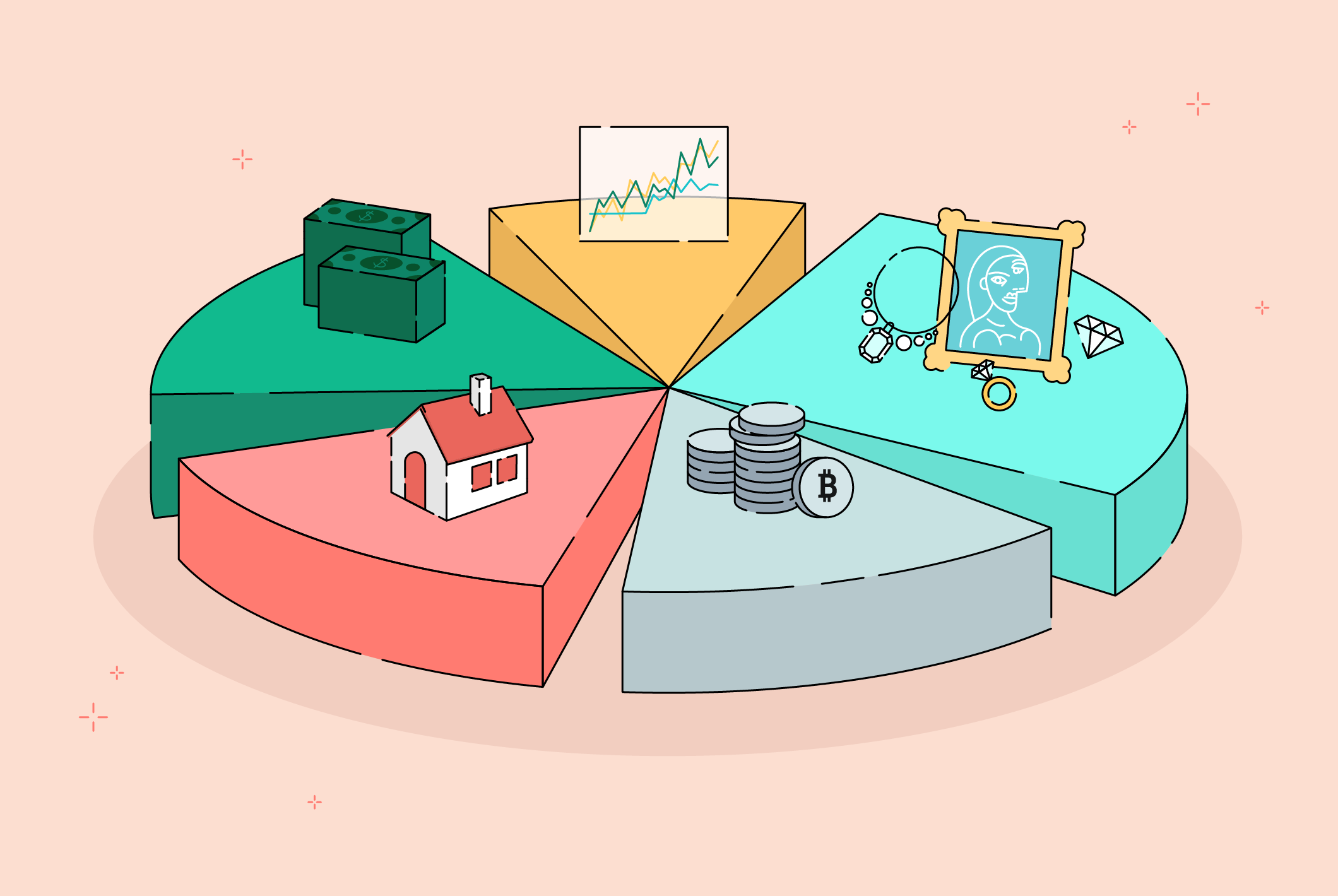

- Diversification benefits

The modern investor is too busy with the stock markets to think about fixed income securities. Students who have just entered into the corporate world are more inclined towards betting via derivatives and ignore guaranteed returns in the hope of making a windfall; in the end losing not only their principal amounts but also the opportunity to earn on that principal.

Lets take a look at how much a person will have after 15 years if he invests as per the following table in the following fixed income securities:

|

Nature of Investment |

Expected Rate of Return |

Amount Invested in 15 years |

Amount after 15 years |

|

PPF |

7.1% |

22,50,000 (1.5 lakhs per annum) |

40,68,210 tax free |

|

Sukanya Samriddhi Scheme |

7.6% |

22,50,000 (1.5 lakhs per annum) |

42,48,290 tax free

|

|

RBI Floating Rate Bonds |

7.15% |

1,50,000 one time |

2,95,850 after tax |

|

Bank FDs |

5.5% |

1,50,000 one time |

2,34,410 after tax |

|

Guaranteed Insurance products |

6% |

15,00,000 (1.5 lakhs per annum for 10 years) |

26,45,831 tax free with 10x insurance cover |

|

Participating Insurance Products |

8% |

15,00,000 (1.5 lakhs per annum for 10 years) |

29,05,037 tax free with 10x insurance cover |

Based on the above table, investors can rebalance the investment portfolio to ensure that the investments in stock markets are not so high that a fall in the markets takes away all their savings.

The right product mix will help you earn a handsome return and at the same time, safeguard you from market shocks. If you have started investing in the markets in the last 2 years, do not put your money in the stock market only. DIVERSIFY.